Private Money Lending: The Smart Investor's Secret to Fast Real Estate Financing

Are you tired of watching prime investment properties slip through your fingers while waiting for bank approvals? In today's competitive real estate market, timing is everything. Private money lending has become the go-to solution for savvy investors who need quick, flexible financing without the bureaucratic hurdles of traditional banks.Why Banks Waste Your Time (And What to Do Instead)

Traditional bank financing might seem like the obvious choice for real estate investments, but experienced investors know better. Banks operate on their timeline, not yours—and in real estate, de lays can be costly.Bank Financing Roadblocks

- 30-45 day closing periods (minimum)

- Rigid income verification requirements

- Low debt-to-income ratio demands

- Perfect credit score expectations

- Limited property condition flexibility

- Extensive documentation requirements

- Multiple approval committees

Private Money Advantages

- Closings in as little as 3-7 days

- Asset-based lending (property value focus)

- Flexible qualification criteria

- Credit challenges accepted

- Funding for properties needing work

- Streamlined documentation process

- Single decision-maker approval

Stop Losing Deals to Financing Delays

Join thousands of successful investors who close deals in days, not months. Private Money Exchange connects you with lenders ready to fund your next project.

TGA Properties Speed of Banks Vs

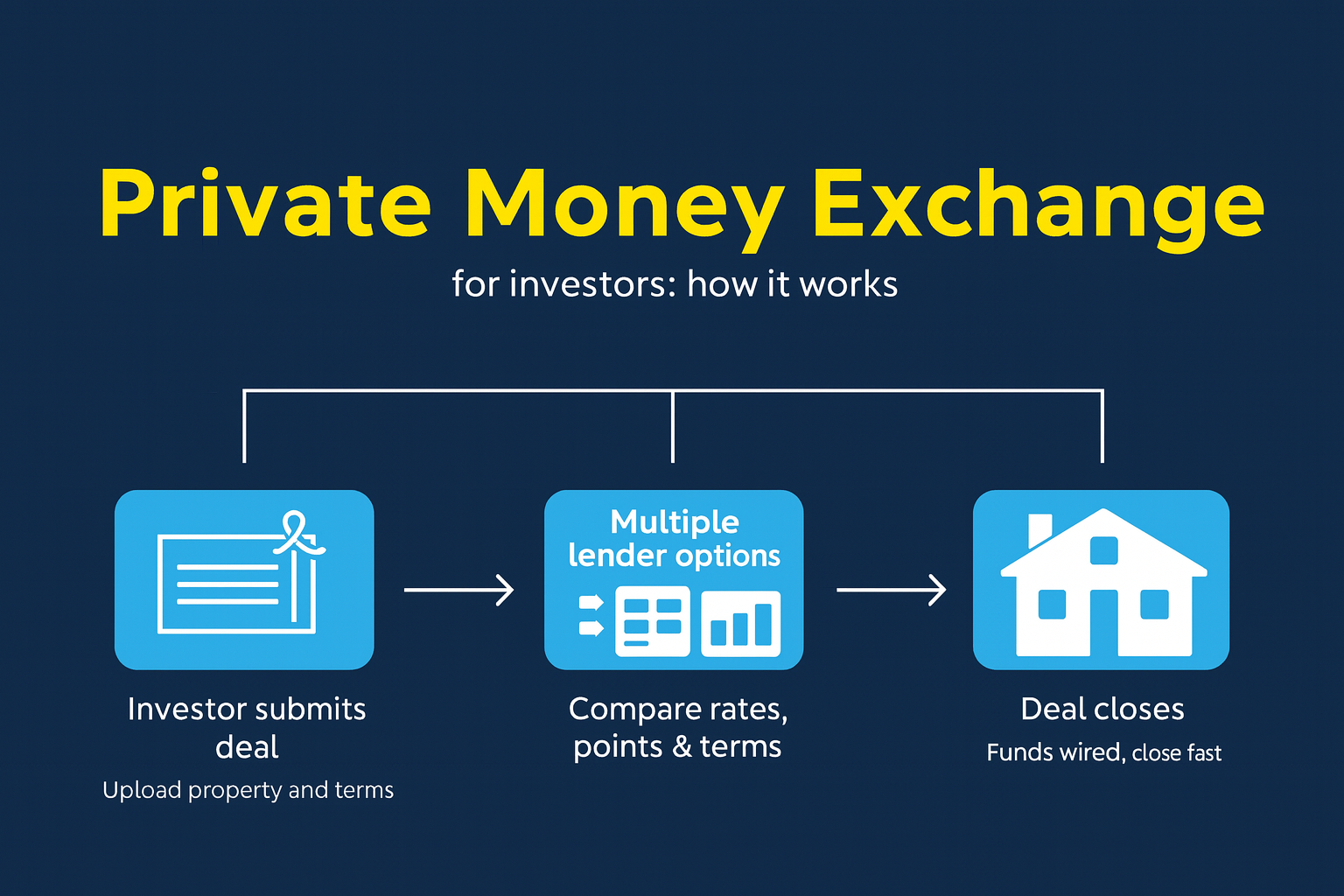

How Private Money Exchange Works for Investors

1. Submit Your Deal

Provide basic information about your investment property and funding needs. Unlike banks requiring mountains of paperwork, our streamlined process focuses on what matters: the property and the opportunity.2. Receive Funding Options

Private lenders in our network review your deal and provide competitive funding options. With multiple lenders competing for your business, you get better terms than approaching a single source.3. Close Quickly

Select your preferred funding option and close in days, not months. Our private money loans focus on the property value rather than your personal financial history, making approval faster and more accessible.

Private Money Loan Options for Every Investment Strategy

Whether you're flipping houses, building a rental portfolio, or developing commercial properties, Private Money Exchange connects you with the right financing solution for your specific investment strategy.| Loan Type | Best For | Typical Terms | Funding Speed |

| Fix & Flip Loans | Property rehabilitation and resale | 6-12 months, interest-only payments | As fast as 3 days |

| Bridge Loans | Gap financing between properties | 3-24 months, flexible payment options | 5-7 days |

| Rental Property Loans | Long-term investment properties | 1-30 years, based on rental income | 7-14 days |

| Construction Loans | Ground-up development projects | 12-24 months, draw schedules | 7-10 days |

| Commercial Property Loans | Multi-family and commercial investments | 1-5 years, value-based underwriting | 10-14 days |

Find Your Perfect Funding Solution

Whatever your real estate strategy, there's a private money solution waiting for you. Stop forcing your deals into bank-shaped boxes.

Explore Loan Options

Success Stories: Real Estate Deals Funded in Days, Not Months

Don't just take our word for it. These real investors used private money to seize opportunities that would have been impossible with traditional bank financing.

"I found a distressed property at 40% below market value, but it needed immediate funding. The bank wanted 45 days just to approve the loan. Through Private Money Exchange, I had three funding offers within 24 hours and closed in 5 days. I've now completed the renovation and sold for a $87,000 profit."

Michael T. - Fix & Flip Investor

"After being rejected by three banks due to having too many properties on my portfolio, I turned to private money. Within a week, I secured funding for a 12-unit apartment building that now generates $5,800 in monthly cash flow. The slightly higher interest rate is nothing compared to the opportunity cost of missing this deal."

Sarah K. - Rental Portfolio Builder

Common Questions About Private Money Loans

New to private money lending? Here are answers to the questions investors frequently ask before making the switch from traditional financing.Aren't private money interest rates much higher than banks?

While private money loans typically carry higher interest rates (usually 7-12% compared to bank rates of 4-6%), the focus should be on the total return on investment, not just the cost of capital. The ability to close quickly on discounted properties, complete renovations faster, and move on to the next deal often results in higher overall profits despite the increased interest cost.

How quickly can I really get funded?

Through Private Money Exchange, most investors receive multiple funding options within 24-48 hours of submitting their deal. Once you select a lender, closing can happen in as little as 3-7 days, depending on the property and loan type. This is dramatically faster than the 30-45+ days required by traditional banks.

What if I have credit issues or irregular income?

Private money lenders focus primarily on the property's value and potential, not your personal financial history. While good credit helps, investors with past credit challenges, self-employment income, or recent career changes can still qualify based on the strength of the deal and the equity position. This asset-based approach is why private money works for real investors in the real world.

What types of properties can be financed with private money?

Private money can finance virtually any real estate investment: single-family homes, multi-family buildings, commercial properties, land, and development projects. Unlike banks that shy away from properties needing work, private lenders often specialize in funding distressed properties, non-conforming properties, and unique investment opportunities.

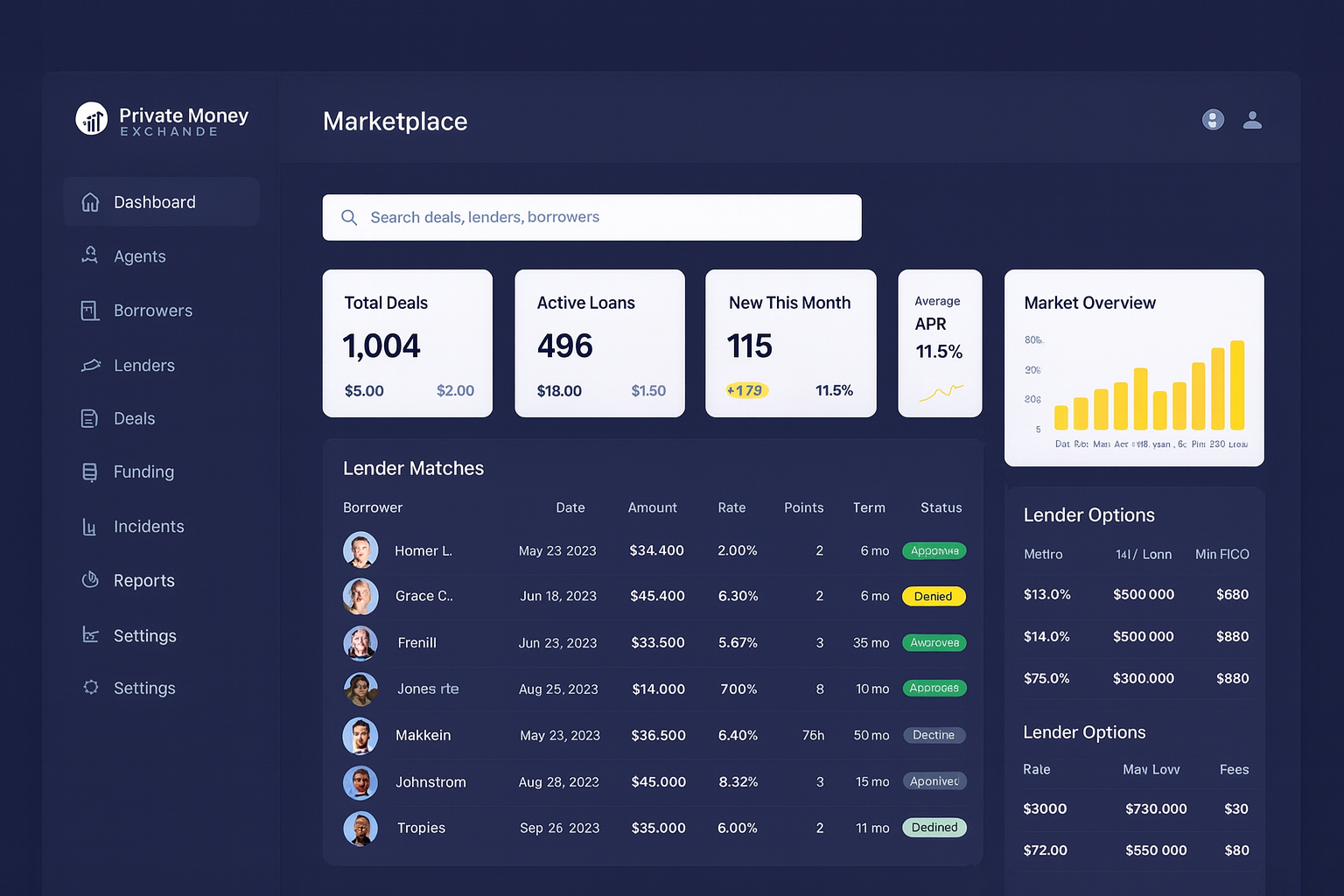

Why Choose Private Money Exchange?

With multiple private lending options available, why do thousands of investors trust Private Money Exchange for their real estate financing needs?

Extensive Lender Network

Access hundreds of private lenders competing for your business, resulting in better terms and higher approval rates than approaching individual lenders.Simplified Process

Our streamlined application takes minutes, not hours. Submit once and receive multiple funding options without repeating paperwork for different lenders.Expert Guidance

Our team of real estate financing specialists helps match your investment strategy with the right lending solution, ensuring you get optimal terms for your specific needs.

"Private Money Exchange has transformed how real estate investors access capital. By creating a marketplace where investors and lenders connect directly, we've eliminated the bureaucracy and delays that kill so many potential deals."

Stop Waiting—Get Your Next Deal Funded Now!

Every day you wait is another opportunity missed. The real estate market waits for no one, and neither should your financing.

Join Millions of Savvy Real Estate Investors

Get funded quickly with capital provided by private lenders – through Private Money Exchange and our network of borrowers and lenders.

ACCESS PRIVATE MONEY NOW